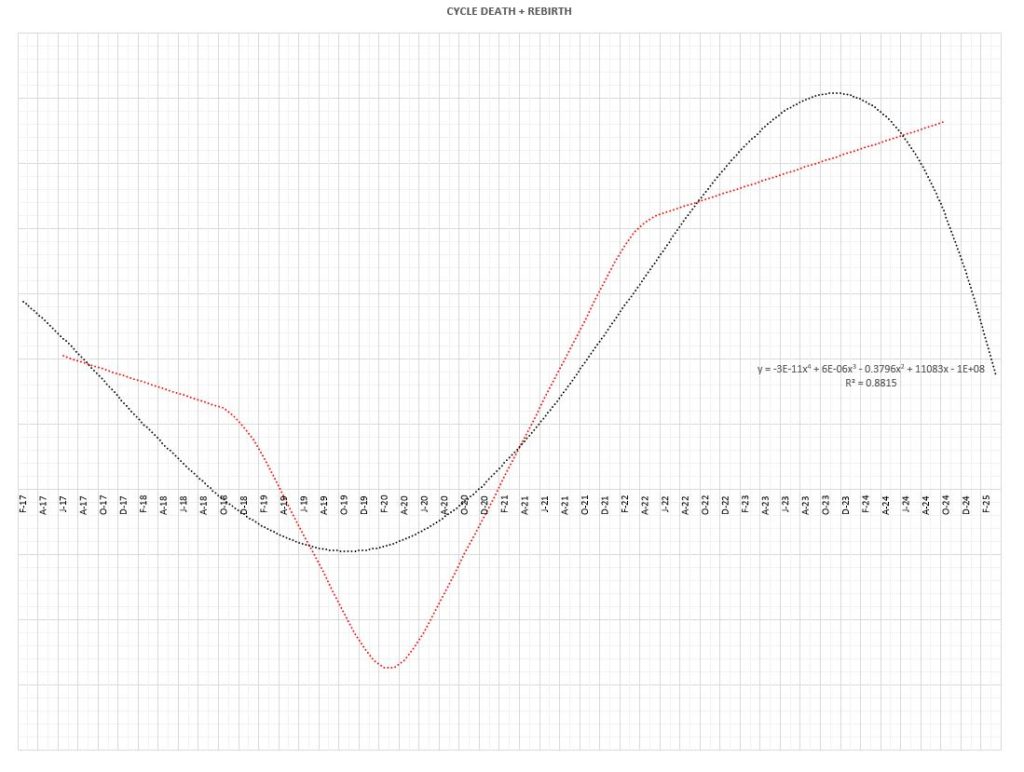

We observe cycle death on a regular basis. It often presages a rebirth. But precious few traders have the stomach for it.

Presently, cycle death has occurred in Fission, Denison, Deep Yellow, NexGen and GoviEx. The cycle, interestingly, remains intact for Forsys Metals. We have an idea why Forsys hasn’t uncoupled from its long-standing cycle, but that’s for another day.

What is cycle death?

It is the point at which price becomes unhinged absolutely from previously established long-term cycle patterns. All of the above-mentioned names shared an almost identical cycle length of XX Weeks (The Basis of Our Approach: An Edge on the Margins).

Cycle death struck Fission at its peak in January ’18 but did not become evident until approximately 12 months later. GoviEx uncoupled from its cycle in April of this year. Denison and Deep Yellow decayed out of the cycle following their respective September ’18 peaks and NexGen has decayed out since November ’18.

Why does cycle death happen?

Cycle death is a process — sometimes a long one — caused by capitulation. Structurally, cycle death and price decay are important for the health of any subsequent recovery. Complacent shorts also are known to add during low-volatility cycle death, which leads to ferocious short covering during the early stages of a recovery.

When does cycle re-birth occur?

We like to see pivot compression, low volatility, flattening price curves, and extrapolated price indicators turn upward before we feel confident calling a recovery.

Conclusion

We like cycle death. It’s one of the more reliable indications of true bottoming, which hasn’t been evident until recently in uranium stocks. It is also the point at which we like to add most aggressively.

I’ve been vocal about the dim prospects for uranium stocks and have on several occasions been adamant about lower prices for longer. But, I’m happy to report that I don’t think prices will remain lower for too much longer, as we’re getting the structural prerequisites ticked off for a rally.

Finally.

2 Comments

“I don’t think prices will remain lower for too much longer”. How much longer do you think uranium prices/stocks will remain low?

Dear, Bob,

Far be it for me to predict the future. I may make a casual sport of forecasting, but at the end of the day, as I am at the mercy of price, I do not fight price. I will never be in the possession of any special knowledge that will confer an edge upon me that also is not at the disposal of my Earthly competitors.

How long will prices remain low? I can’t answer that particular question. One thing, however, I do know: stocks can’t drop lower than zero, and many of our precious pet uranium stocks are darned close to zero, both absolutely and in relative terms. It follows that a recovery is a function of the rate at which the gap between market value and oblivion is closed. And as that gap is closing quickly, one may rightfully assume that a turn is fast approaching.

We study long-term cycles here at FCM. We watch them and respond to them, even if we do not understand why they operate as they do. There are forces much larger than ourselves and to which all news cycles and fundamentals are subordinate, and it shapes the cycles in which we find ourselves.

Merry Christmas, Bob,

Tom